Malhotra & Assoc. Insurance Has You Covered

Original Medicare, the traditional insurance plan offered by Medicare, can be supplemented with a Medigap policy. Medicare Supplement (Medigap) plans can be used to lower your out-of-pocket medical costs and give you the BEST coverage during your golden years.

At Malhotra & Assoc. Insurance, we’ve helped many satisfied customers find the right Medigap plan that provides peace of mind in retirement. We can help you, too! Just use this Medigap plan comparison guide to learn what your options are.

Choose a location:

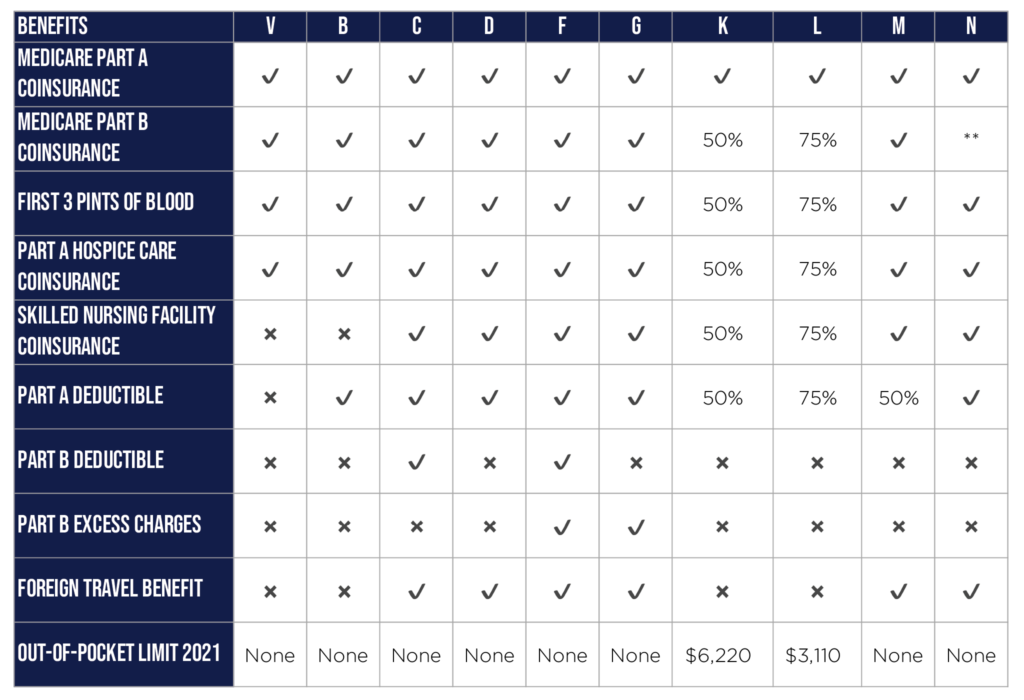

Medicare Supplement plans chart

It’s much easier to compare the ten different Medigap plans if you break them into categories. We prefer to think of them in these different categories; basic, comprehensive, and cost-sharing.

The basic plans will cover minor Medicare-related costs, while the comprehensive plans will take care of the larger expenses, like deductibles. Cost-sharing plans are different, as they only cover a percentage of the same costs featured in other Medigap plans.

This is what you need to know about the benefits offered in each type of plan:

Even the most basic Medigap plans provide valuable benefits. These are the basic benefits you can expect to find in all plans, including the simple policies like Plan A and Plan B.

Other policies, like Plan C, Plan F, Plan G, and Plan N will include more extensive benefits. Advanced benefits include:

Cost-sharing plans are different from other Medigap plans because they only cover a percentage of the costs that are covered by the plan. Plan L, for example, only covers 75% of the costs featured in the plan, while Plan K only covers 50%. These cost-sharing plans are lower cost than many other options, so they are a great choice if you want some coverage but also want to save money on your premium payments.

The benefits featured in Plan K and Plan L include:

Malhotra & Assoc. Insurance has many years of experience of working with clients just like you. We can help you sort through the different Medigap plans. To get started, just give us a call.

2022 © Malhotra & Assoc. Insurance. View our Privacy Policy.