Choose a location:

Each state has different requirements that they expect all insured motorists to follow. These rules typically include a minimum bodily injury liability coverage amount, minimum coverage for uninsured or underinsured motorists, and minimum property damage liability coverage amount.

Speak with our agents about the requirements in your state for car insurance liability coverage.

After an accident, you can call your insurer to file an insurance claim. The insurance underwriter will evaluate the damages and then offer compensation for repairs. At-fault wrecks, severe traffic violations, and multiple claims or tickets can cause your car insurance rates to increase.

Basic coverage is the minimal amount of coverage needed to meet the requirements set in your state. This coverage helps pay for the costs if you are found to be at-fault for a collision with another vehicle or have damaged someone’s property. Basic coverage may not be enough to cover the expenses for expensive or extensive repairs or continued medical expenses.

Additional coverage can give you peace of mind. You can opt into one of the following:

You can often choose to pay for your car insurance on a monthly or annual basis. Some carriers offer discounts for paying in full. In other cases, a monthly direct debit payment may be more convenient. Get a quote for coverage on both a monthly and annual basis then compare the cost to find your best price.

You will be charged a premium, which you pay either in full annually or in monthly direct debit payments, and you will need to pay a deductible. The deductible is the total amount of money you pay prior to receiving any compensation from the insurer.

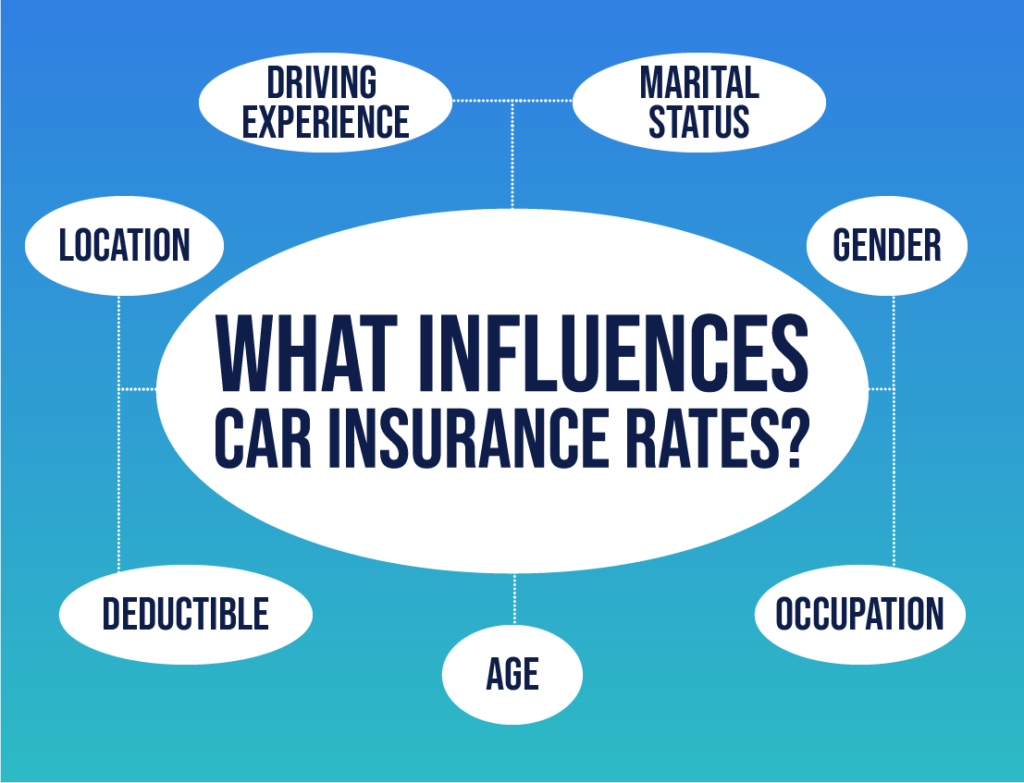

Many factors influence the cost of your car insurance rates. Assumed risk is a major factor in determining your rates. Drivers who are more likely to file an insurance claim usually pay more for their car insurance.

The cost of your car insurance policy is determined by your:

Bundling your car insurance with coverage from the same insurer you have other policies with, such as your homeowners insurance, can be a great way to reduce the cost of your car insurance.

2022 © Malhotra & Assoc. Insurance. View our Privacy Policy.